Beyond the Canal: Evaluating the True Cost of Rerouting via the Cape of Good Hope

In global maritime logistics, route selection is a strategic decision that directly influences operational costs, voyage duration, and overall efficiency. For crude oil tankers, two primary routes dominate the discussion the Suez Canal, offering a shorter passage between Europe and Asia, and the Cape of Good Hope, a toll-free but considerably longer alternative.

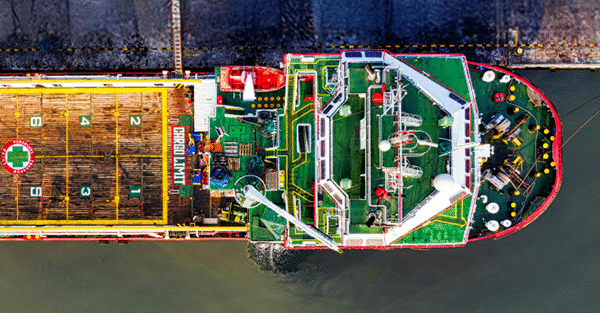

At Manta Marine Services, the right route choice is viewed as a key factor in achieving both profitability and performance. Using the 5 Basic Objections framework, this analysis compares voyage costs and broader operational implications of these two vital maritime routes.

- Cost of Transit

The Suez Canal imposes tolls that range between $30,000 and $450,000, depending on vessel type and size. While the Cape of Good Hope does not require such tolls, the extended sailing distance results in additional fuel consumption and voyage expenses, which can add $50,000–$100,000 or more per trip.

At Manta, cost-efficiency extends beyond immediate expenses. Through effective provision and logistics support, tanker operators can manage voyage economics comprehensively, minimizing total operational costs through smarter planning rather than simple toll avoidance.

- Voyage Duration and Time Sensitivity

The Suez Canal offers a time-saving advantage of roughly 7–10 days compared to the Cape route. For crude oil traders and ship operators, reduced transit time translates into faster delivery, optimized scheduling, and improved market responsiveness.

However, the Cape route introduces uncertainty, from unpredictable weather to longer exposure at sea. Manta’s real-time coordination and port support services across Egyptian terminals ensure that vessels passing through the Suez Canal operate efficiently, minimizing downtime and optimizing voyage schedules.

- Operational and Maintenance Costs

Longer voyages increase mechanical wear, maintenance cycles, and crew fatigue, leading to higher operational costs over time. The shorter Suez Canal route, meanwhile, allows for better fleet utilization and less equipment stress.

Through technical supply, deck and engine stores, and maintenance support, Manta helps operators control these costs effectively, ensuring reliable performance and extended vessel longevity.

- Environmental and Insurance Costs

Both routes carry distinct risk and environmental profiles. The Cape of Good Hope exposes vessels to higher piracy risks off East Africa, leading to increased insurance premiums. The Suez Canal, while safer, presents its own environmental management challenges, especially for large crude carriers.

Manta prioritizes safe and compliant maritime operations, assisting clients in mitigating risk through secure logistics coordination, proper documentation, and alignment with international maritime safety standards.

- Market Conditions and Flexibility

Global market dynamics, from fuel price fluctuations to geopolitical events, can rapidly shift the balance between these two routes. During disruptions in the Red Sea or Suez region, the Cape serves as a necessary alternative, though with higher cost implications.

Manta’s strategic insights and adaptive operational support enable ship operators to respond swiftly to such challenges, ensuring continuity and efficiency across all voyage scenarios.

Conclusion

The decision between navigating the Suez Canal or the Cape of Good Hope extends beyond tolls and distances it is a strategic evaluation of cost, safety, efficiency, and flexibility.

At Manta Marine Services, we help our partners make informed choices by providing end-to-end marine support, from provisions and logistics to technical and operational efficiency. Our commitment to quality, reliability, and timely service makes Manta a trusted ally for tanker operators navigating the complexities of global trade.